7 Innovative AI Tools to Supercharge Your Investment Strategy

The days of relying solely on gut feelings and traditional market analysis may be numbered. As artificial intelligence reshapes the financial landscape, sophisticated AI tools are emerging that give both novice and experienced investors access to capabilities once reserved for major institutions. These platforms go beyond basic market tracking, using advanced machine learning to spot patterns, predict trends, and optimize investment decisions in ways human analysts simply couldn't match. In this article, we'll examine seven standout AI investing platforms – Extracto, Kavout, Auquan, Trading Technologies, TrendSpider, AlphaSense, and SigOpt – and explore how their innovative approaches to market analysis could help strengthen your investment strategy. Whether you're a seasoned trader or just starting out, understanding these tools could give you a valuable edge in today's fast-moving markets.

extracto

AI web scraper that automates data collection instantly

Extracto.bot gives you a powerful web scraper that works seamlessly with Google Sheets helping investors collect data automatically without any setup needed. Its AI features let you pull specific information from basically any website without dealing with complex code or configurations. You just set up your columns in Google Sheets go to the website you want data from and hit "extract" to fill your spreadsheet instantly. This gets rid of the boring manual work of gathering data which gives you more time to analyze and make decisions. Investors use it for things like researching sales prospects on LinkedIn Facebook and company sites comparing prices across stores and organizing real estate data from listing websites.

The platform is super easy to use since it's built right into Google Sheets which most people already know how to use. They offer different plans starting with a free version that lets you scrape 20 pages monthly, going up to their pro plan at $39 per month with unlimited pages and 5 user accounts - so it works for both individual investors and bigger teams. Using Extracto.bot can really improve how efficiently you work by automating data collection for fundamental analysis market research and finding deals which helps you make investment decisions faster and smarter.

Link: https://www.extracto.bot

Kavout

AI-powered investment analysis for smarter trading decisions

InvestGPT brings together several AI tools that help improve how you invest. It has this neat AI Stock Picker that looks at stocks using ten different methods like Dynamic F-Score and Lynch Growth to figure out which ones might be worth buying. The tool ranks stocks of all sizes and gives you a clear picture of what's happening. When you check out the MarketLens part, you'll find detailed write-ups about specific companies and what's going on in the markets overall.

The platform lets you keep tabs on stocks you're interested in with a simple watchlist feature. But it goes beyond just watching individual stocks too. You can see what big-time investors are buying and holding in their portfolios through the Superinvestor Portfolio tool, and even track what members of Congress are trading. The platform also keeps an eye on what's buzzing on places like WallStreetBets and other social media. While there's lots of helpful stuff here including a glossary and API access for the tech-savvy folks it's important to remember their disclaimer: this is all for information purposes and shouldn't replace getting professional investment advice. Think of InvestGPT as your research buddy that helps you make more informed decisions about your investments.

Link: https://kavout.com

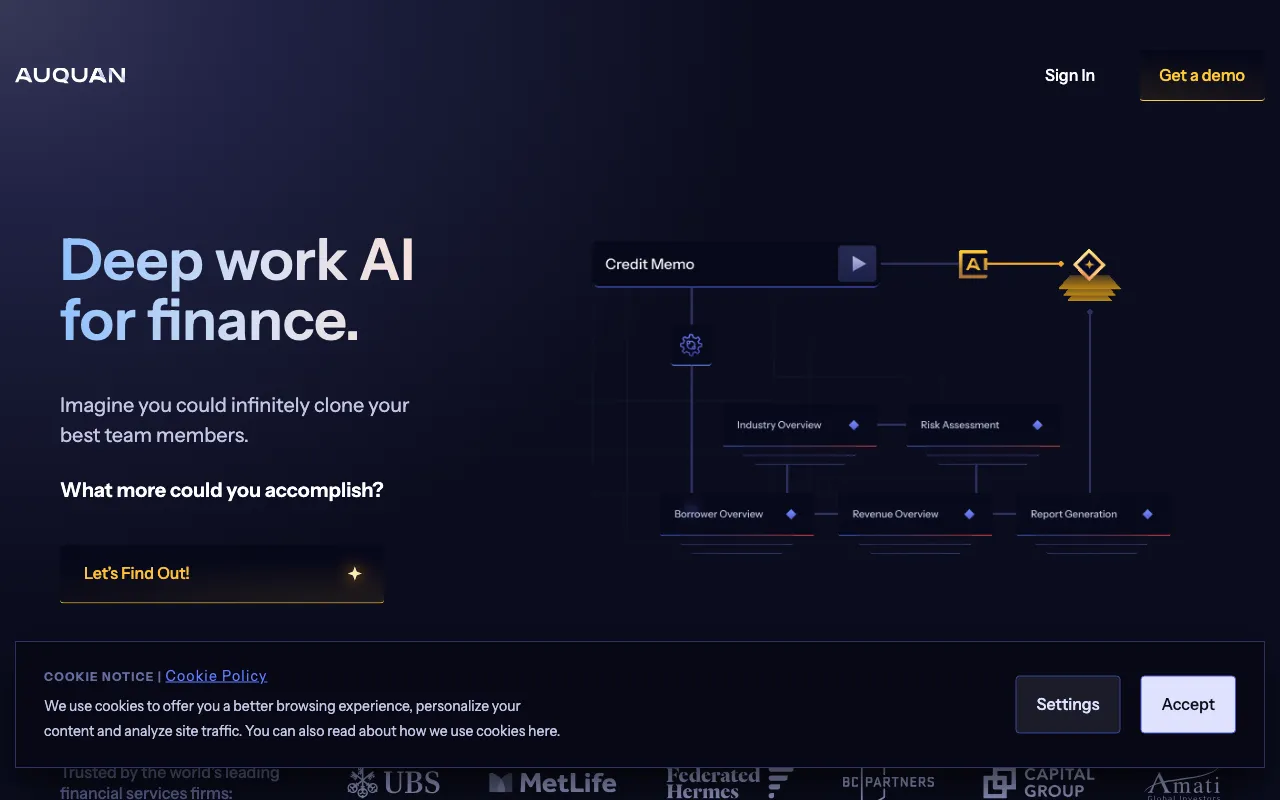

auquan

AI-driven platform that revolutionizes financial research and reporting.

Auquan helps financial professionals work smarter using advanced AI technology. It cuts down on tedious manual work by automating research, monitoring and reporting - saving teams up to 80% of their time. A Head of ESG at a major wealth management firm found that having pre-written reports lets their analysts focus more on developing valuable insights rather than just gathering data.

The platform handles everything from due diligence and portfolio tracking to comparing deals and analyzing ESG factors. What makes it powerful is how it processes over 2 million datasets including global news, regulations and other sources in more than 65 languages. This lets Auquan create accurate draft reports straight from raw data without any AI hallucinations.

Financial firms across private equity, credit and asset management rely on Auquan to speed up their investment process. The platform generates investment committee memos, conducts ESG reviews and assesses risks comprehensively. Top financial institutions trust it because of robust security features like SSO authentication enterprise support and SOC2 II compliance. This comprehensive toolset helps teams make better investment decisions while spending less time on routine tasks.

Link: https://auquan.com

tradingtechnologies

Advanced multi-asset trading platform for superior market execution.

Trading Technologies or TT is a complete platform for trading capital markets that covers futures & options, fixed income, FX and crypto assets. Their solutions handle every part of trading with some of the fastest execution speeds available today using top-tier tools for trading charts, spreads and algo strategies. They provide solid data features including market feeds, data processing and storage which helps traders make better choices and stay compliant. The platform uses machine learning to watch trading patterns and manage risks which is important for complex trading approaches.

TT built their system to be fast reliable and secure which helps it work better than most. Their tools include everything from basic order management to detailed charts, spread tools, algorithmic trading and complete API access. This makes it really useful for both individual traders and big institutions that need good execution and deep analysis for their strategies. The platform also has special "TT Premium" order types that let traders handle complex orders across different types of assets in smart ways.

Link: https://tradingtechnologies.com

TrendSpider

AI-driven platform for smarter market analysis and trading

TrendSpider helps investors spot opportunities and build trading strategies using AI-powered tech. The platform understands plain language when you describe market conditions just like talking to a friend and turns those words into actionable signals. With its mix of machine learning and algorithmic analysis it makes the whole investment process smoother especially for those who want to create and test strategies without knowing how to code.

The platform comes packed with everything from technical charts to real-time trading ideas and lets users tap into various third-party tools and scanners. You'll find free market scanners that send daily alerts about market conditions, plus helpful calculators for figuring out risk levels profit and loss scenarios and position sizes. What's really cool is how the AI can spot chart patterns, trendlines and Fibonacci levels with mathematical accuracy.

One of the best things about TrendSpider is how much control it gives users - you can adjust pretty much everything to match your trading style. But it's important to remember that while TrendSpider provides powerful tools, they're not meant to be taken as investment advice. Users should always do their own research and thinking before making any trades.

Link: https://trendspider.com

Alphasense

Advanced gas sensors powering critical environmental monitoring solutions

Alphasense has spent over 25 years becoming a global leader in high-quality gas and particulate sensor technology. Their sensors find use across many applications from air quality monitoring to environmental tracking and industrial gas detection. The company produces various sensor types including oxygen CO2, toxic and flammable gas sensors along with particle counters that deliver best-in-class accuracy for PPB and PM monitoring. These precision instruments generate reliable data that's essential for environmental and industrial safety assessments, which can provide valuable indirect insights for investors looking at companies through an ESG lens.

Though Alphasense isn't directly in the AI investing space their highly accurate sensor data plays a crucial role across industries that influence investment choices. The company's track record of quality performance and low warranty claims demonstrates how dependable their products are when it comes to consistent environmental and industrial data collection. This reliability is particularly important for building accurate models and forecasts in financial analysis especially for industries that need to watch environmental regulations or accident risks closely. Their technology thereby provides indirect but valuable support for making well-informed investment decisions.

Link: https://alphasense.com

sigopt

AI-driven optimization for complex investment models and simulations.

SigOpt provides an open-source platform you can host yourself for AI optimization, which works great for investment strategies that use complicated models and simulations. The platform includes a "SigOpt-Lite" module that runs calculations locally, helping with privacy and making it easy to fit into your existing workflow. It comes with useful features like progress tracking visualizations and works well with XGBoost for fine-tuning parameters, which helps speed up how fast you can develop and improve quantitative investment models.

The tool has proven itself useful across many fields. Researchers at the University of Pittsburgh use it for additive and nanomanufacturing while the University of Arizona applies it to materials science research. Even MIT uses it to develop new materials by combining machine learning with physical sciences. This versatility makes it really valuable for investment professionals who need to optimize things like portfolio construction risk management or trading algorithms. It lets them explore different parameters efficiently to maximize returns while keeping costs down. Since users can run their own server they maintain complete control of their data and experiments.