5 Ground-Breaking AI Tools Transforming Modern Finance

Today's financial landscape is drowning in data, yet transforming this wealth of information into actionable insights requires more sophisticated solutions than ever before. Traditional spreadsheets and manual analysis simply can't keep pace with modern market complexities. Fortunately, a new wave of AI-powered tools is transforming how financial professionals work, from automating routine tasks to uncovering predictive patterns that were previously invisible. In this article, we'll examine four innovative platforms that stand at the forefront of this revolution: Extracto, which seamlessly pulls web-based financial data into spreadsheets; Auquan, an AI platform that streamlines complex workflows; Alpaca, a developer-friendly API toolkit for building advanced financial applications; and Kavout, which leverages AI to deliver data-driven investment insights. These tools represent more than just technological advancement - they're reshaping how financial professionals compete and succeed in today's lightning-fast markets.

extracto

Web scraping tool for easy finance data collection in sheets

Extracto.bot makes web scraping super simple by working right inside Google Sheets which is perfect for finance pros who need data fast. You won't have to deal with complicated setup - just point it at the website data you want and click. Financial teams use it to grab sales leads from LinkedIn and company sites compare prices across different platforms and collect property details during investment research. The extract feature works smoothly letting you specify what data you want and pull it straight into your spreadsheet.

The tool keeps things straightforward with simple pricing and focuses on being easy to use which makes it really valuable for finance work. Whether you're building sales lead lists doing market research or analyzing investment properties being able to automatically grab web data into your sheets helps you make better decisions. Since it works with Google's tools its super easy to share and work on the data with your team which saves tons of time you'd normally spend on manual data entry. The whole system just works together nicely to help finance teams get more done.

Link: https://www.extracto.bot

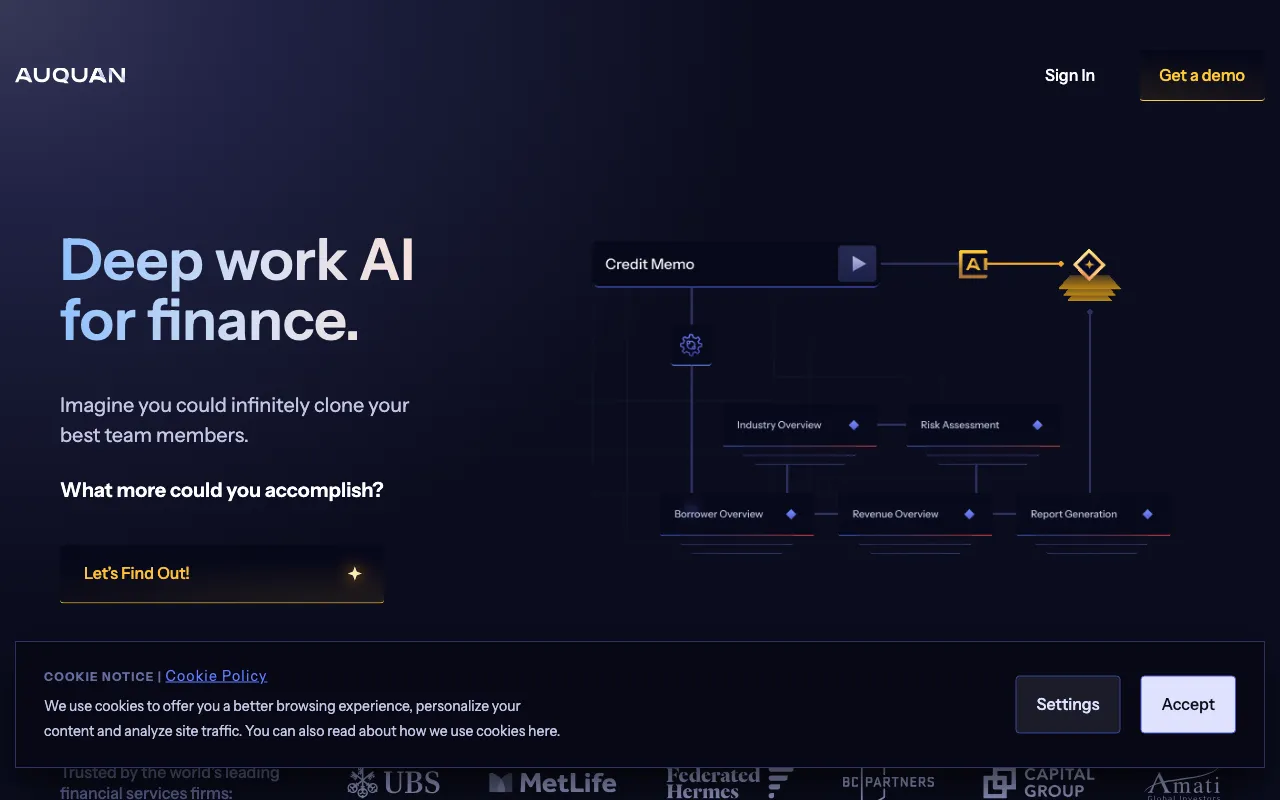

auquan

AI automation platform that revolutionizes financial workflow efficiency

Auquan provides AI solutions that drastically cut down manual work in finance. The platform uses AI agents and RAG technology to automate complex tasks like investment memos, due diligence work and portfolio tracking. It also handles ESG integration and helps with regulatory compliance reports. By automating these time-consuming jobs Auquan helps finance pros spend about 80% more time on strategic work and important decisions that need human input.

The platform connects to millions of datasets, both public and private along with global news sources and regulatory information. This gives deep insights for various finance sectors including PE firms, asset managers investment banks and insurance companies. Major financial institutions have seen great results with Auquan - some saying they can now create credit memos in minutes instead of days. The platform is also really good at KYB compliance and keeping track of negative media coverage.

One key thing about Auquan is that it produces reliable outputs without making things up, which is crucial in finance. It covers more than 550,000 companies worldwide and works in over 65 languages which makes it useful for global organizations. The platform takes security seriously with SOC2 II and GDPR compliance making it a trusted choice for regulated financial institutions.

Link: https://www.auquan.com/

Alpaca

A powerful API toolkit for building financial applications

Alpaca provides a comprehensive set of APIs that help developers and businesses create trading solutions and financial technology applications. Their straightforward APIs make it simple to implement algorithmic trading, connect apps and build custom financial services. The platform uses a unified approach that combines investing, brokerage services, custody and post-trade processing through one streamlined API structure. This makes it particularly valuable for fintech startups digital wallets, broker-dealers and other financial organizations looking to expand their capabilities.

The platform includes several key features like commission-free stock trading via API integration, enhanced security through OAuth, support for margin and short selling and a testing environment for development. They provide SDKs in multiple programming languages including Python, .NET/C#, Go and Node.js which gives developers flexibility in implementation.

Their APIs handle trading across different asset types including US stocks ETFs, options and cryptocurrencies. Alpaca continues to innovate with new offerings like Funding Wallets for Broker API and Local Currency Trading API showing their dedication to building a complete global platform. These features enable local currency transactions precise account allocation and the ability to view stock prices and portfolios in local currencies which greatly improves the experience for international users.

The platform maintains strong security practices and provides investor protection through FINRA and SIPC membership. With commission-free stock trading through their API, Alpaca delivers an excellent toolkit for businesses wanting to create innovative financial services and applications.

Link: https://www.alpaca.markets/

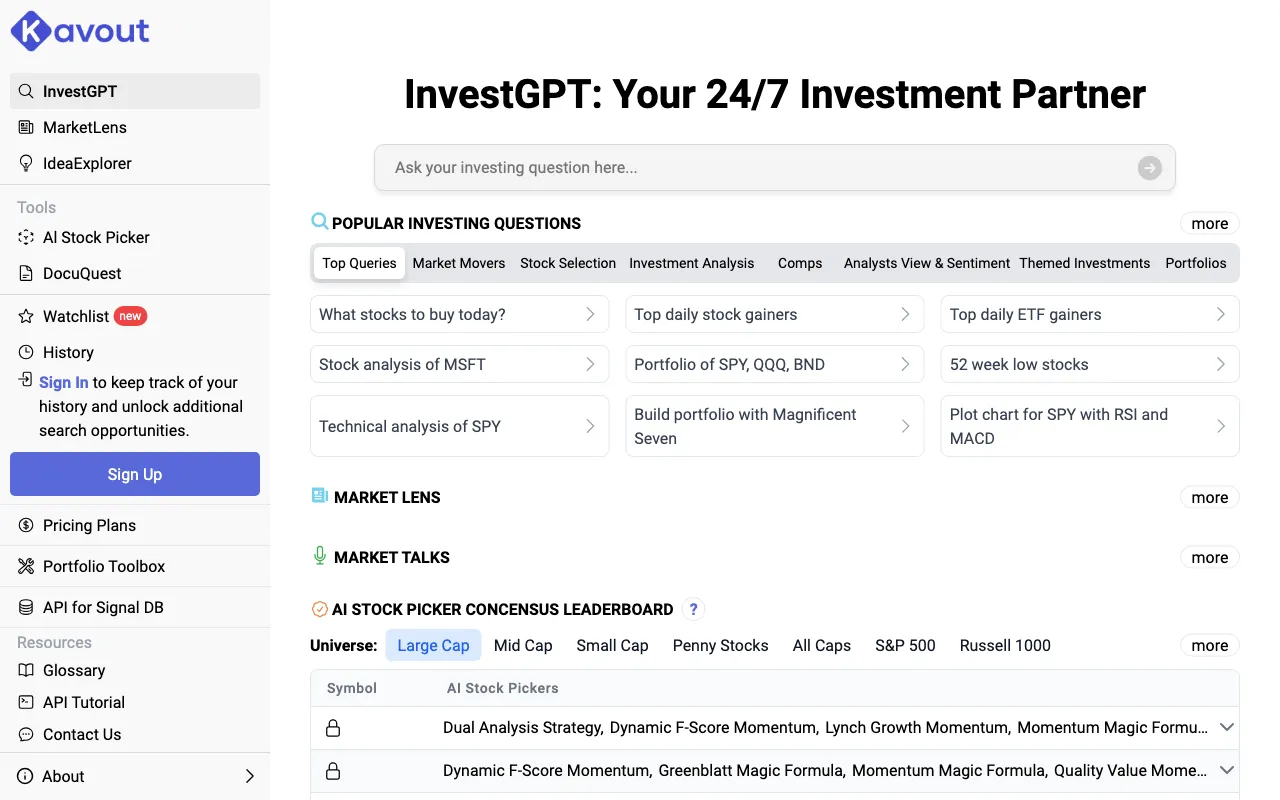

Kavout

AI-powered investment analysis for data-driven market insights

InvestGPT gives investors powerful AI tools that make investment research and analysis much easier. It handles basic questions like "What stocks should I buy?" and delivers detailed stock analysis, portfolio tools and technical charts - basically working as your always-available investment buddy. The platform includes neat features like "Market Lens" which provides commentary on hot stocks and market trends, plus an "AI Stock Picker" that combines suggestions from different AI models. It also tracks things like insider trading patterns and what superinvestors and congress members are doing with their portfolios which helps give investors lots of useful data points.

For the finance pros out there InvestGPT is super helpful for spotting market trends and finding good investment opportunities. The AI-powered insights about market movements, stock picks and themed investments can really help with generating trading ideas and figuring out market sentiment. You also get access to helpful stuff like the "Portfolio Toolbox" and "Signal DB API" which makes it easier to manage portfolios and connect with your existing systems. While InvestGPT provides tons of great info it's important to note their disclaimer that they only provide information resources not financial advice. You should still do your own research and talk to qualified advisors before making any investment decisions.